Thank you for the influx of new subscribers and apologies for the delay since the last article. We will continue to post in-depth profiles of standout private equity investments like this one.

Introduction

Picture a company involved in one of the most significant technological phase shifts: cloud computing. Now, envision this company competing against giants like AWS, Microsoft Azure, and Google Cloud Platform. This is the story and analysis of Apollo’s 2016 buyout of Rackspace.

Rackspace

In 2016, Rackspace Technology was a managed hosting company. With origins as a competitor in the IaaS (infrastructure-as-a-service) industry, the company evolved into a hosting company with a hybrid model, allowing businesses to run their software either on a private or public cloud. A brief history of Rackspace up until 2016 and the state of Rackspace today is provided in the appendix.

Distinguished by its focus on managed hosting and private cloud solutions, Rackspace placed a strong emphasis on customer support and managed services. In contrast, AWS and Azure primarily offered public cloud services with a self-service, on-demand model. Rackspace’s managed services assisted enterprises in designing, building, and operating cloud environments across the hyperscalers’ platforms.

In 2016, Rackspace’s core business was Single Tenant (dedicated hosting and private cloud). This segment accounted for 72% of its revenue, 79% of EBITDA, and 90% of FCF. Public Cloud (IaaS, competing against the hyperscalers) contributed 23% of revenue, 19% of EBITDA, and 10% of FCF. Managed cloud services (involving resale of AWS or Azure infrastructure with added managed services) and cloud office management (for applications) were identified as growth opportunities.

Apollo

Apollo Global Management is an asset management firm with a private equity business. Adopting a value-driven approach akin to Benjamin Graham and Warren Buffet’s famed “cigar butt” strategy, Apollo targets companies that have faced temporary setbacks but retain underlying value.

The Deal

On August 26th, 2016, Apollo announced its intended $4.3bn purchase of Rackspace. The buyout was financed with $1.3bn of sponsor equity and $2.2bn of debt [2].

Apollo’s Investment Thesis

Apollo had a six-part investment thesis [2] explained below:

1. Rackspace is well-positioned to benefit from “robust secular tailwinds”

Rackspace is poised for substantial TAM growth. Key opportunities include:

Increased Outsourcing: The anticipated rise in data center outsourcing, from 12% of requirements in 2016 to 21% by 2019, presents a significant opportunity.

Workload Growth: The global growth in installed workloads, with a ’14-‘19 CAGR of 20%, will further boost demand for outsourced data center services. These workloads are becoming increasingly complex.

Multi-Cloud Shift: The growing trend towards multi-cloud environments, necessitated by diverse IT landscapes and applications across multiple technology platforms, favors Rackspace. Multi-cloud solutions are optimal for managing complex and varied workloads, positioning Rackspace as a one-stop shop for multi-cloud customers.

Market Growth: Rackspace's end markets are expected to experience double-digit annual growth, expecting the Single Tenant market to grow at a ‘16-’19 CAGR of 12% and Public Cloud at 26%.

2. Rackspace is a “leading global multi-cloud solutions provider”

Market Leadership: Rackspace is a leading player in several high-growth markets, particularly in its core Single Tenant business.

Unique Multi-Cloud Offering: Rackspace stands out as one of the few multi-cloud providers with a comprehensive portfolio of data center services, offering a high-value proposition to customers.

Superior Customer Service: Rackspace differentiates itself from competitors by delivering exceptional customer service, branded as “Fanatical Support.”

Growth Potential in Managed Services: Apollo anticipated that approximately 50% of future AWS users and 70% of Azure users will seek managed services, highlighting a significant growth opportunity for Rackspace.

3. Rackspace’s “recurring revenue business model provides material downside protection”

Stable Recurring Revenue: Recurring revenue makes up 99% of Single Tenant revenue, which generates approximately 90% of Rackspace’s FCF.

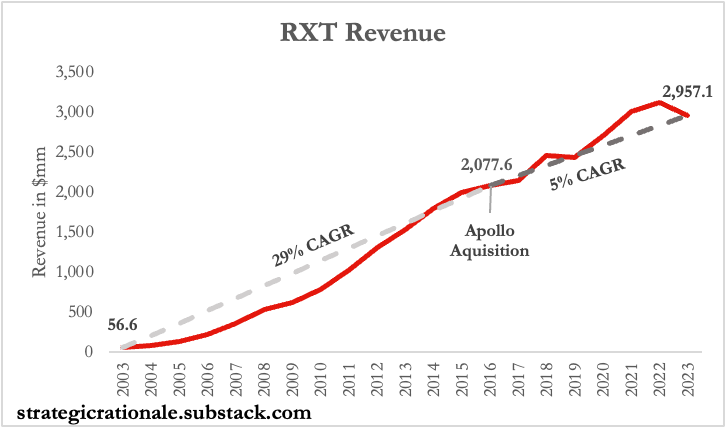

Strong Organic Growth: Rackspace has achieved organic growth with EBITDA increasing by 155% over the past five years, representing a 20.3% CAGR. The company has consistently maintained revenue growth without a single year-over-year decline.

Efficient Customer Acquisition: Rackspace’s average CAC payback period is 2-3 years, compared to an average customer lifespan of 6-8 years, based on a churn rate of approximately 0.7%, significantly lower than industry peers.

4. Rackspace has a “strong free cash flow profile”

Capex Efficiency: Opportunities for capital expenditure efficiencies arise as the business mix shifts towards capital-light Managed Cloud services.

Strong Single Tenant Business: Rackspace’s Single Tenant business, generating approximately 90% of FCF, remains robust and has limited reliance on the Public Cloud segment, which accounts for about 10% of FCF.

5. Rackspace has ample “operational improvement opportunities”

Cost Savings: Apollo has identified substantial potential for cost savings that could be realized within 12 months post-acquisition. Much of this opportunity is expected to come from 1) rationalization of 3rd party spending (maintenance contracts on non-standard hardware) and 2) consolidation of IT infrastructure, facilities, and other opex through de-prioritization of low-priority software and internal IT projects.

New Business Development: Rackspace is well-positioned to capitalize on “new business development opportunities.”

6. Rackspace has a “strong management team and culture that drives success”

Dedicated Team: A committed senior management team and loyal employees ("Rackers") who are fully aligned with the company's vision.

Apollo Investment Thesis Port-Mortem Analysis

This section delves into a post-mortem analysis of each of Apollo’s six investment theses, aimed at identifying where the investment strategy deviated from its anticipated path and what factors contributed to the variances.

1. Rackspace is well-positioned to benefit from “robust secular tailwinds”

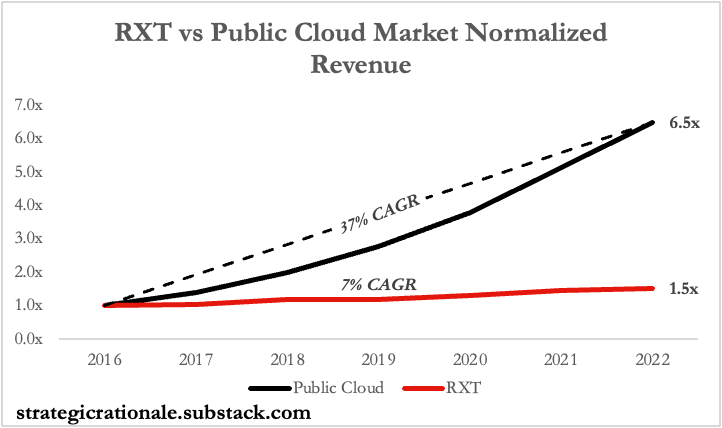

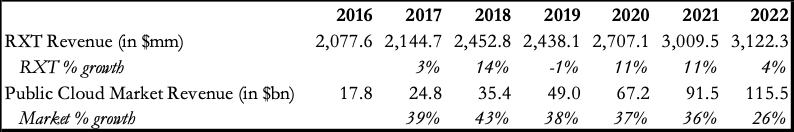

Although Apollo was correct that the secular tailwinds would be favorable, Rackspace did not capitalize on them. From 2016 to 2022, the share of data stored in the cloud (compared to on-prem storage) surged from 35% to over 60%, while the cloud computing and hosting market expanded from $72bn to over $156bn. During this same period, revenue in the public cloud services market soared from $18bn to $116bn, reflecting a CAGR of 37%. In contrast, Rackspace’s revenue grew from $2.1bn to $3.1bn, a CAGR of 7%.

2. Rackspace is a “leading global multi-cloud solutions provider”

While Rackspace was a leading player in its core business, Single Tenant, this leadership position was not particularly significant. In 2016, Rackspace held only ~9% market share, which has plummeted to ~1% [4]. The fundamental issue is that Rackspace lacked a moat to secure a durable competitive advantage. Although it’s possible to build cost advantages in public cloud environments (i.e., AWS reduced prices 107 times from 2006 to 2021), Rackspace lacked the scale and critical assets (it leases data center capacity) necessary to price lower than its competitors. Furthermore, the hardware and software Rackspace offers are available to every firm, and Rackspace does not own or control any unique intellectual property that provides a competitive edge in either cost or performance.

Because data center owners will provide access to space and power to nearly anyone, competitors can enter the cloud hosting market relatively easily by leasing data centers. The cloud MSP market consists of a large number of small players, indicating the market structure does not benefit from efficient scale. Managed hosting and public cloud services are commodity-like businesses with low switching costs, as data is stored with the underlying cloud provider (e.g., AWS) rather than the service provider. This means many providers offer the same services, leaving Rackspace with little pricing power.

Rackspace’s competitive advantage was its customer support (“Fanatical Support”), but this advantage has eroded, giving businesses no reason to choose Rackspace for managing and storing their data. A quick search on Reddit for “Rackspace customer service” reveals only negative threads with titles such as “What happened to Rackspace? They used to be so good but now they're awful” and “Rackspace has gone to shit.”

3. Rackspace’s “recurring revenue business model provides material downside protection”

Rackspace’s recurring revenue model didn’t offer much downside protection. The company’s cloud services contracts have short durations, typically lasting only a year. This allows customers to easily churn, as switching costs are minimal. This vulnerability is evident in their drastic 68% drop in customers, from ~300k in 2015 to ~95k in 2023.

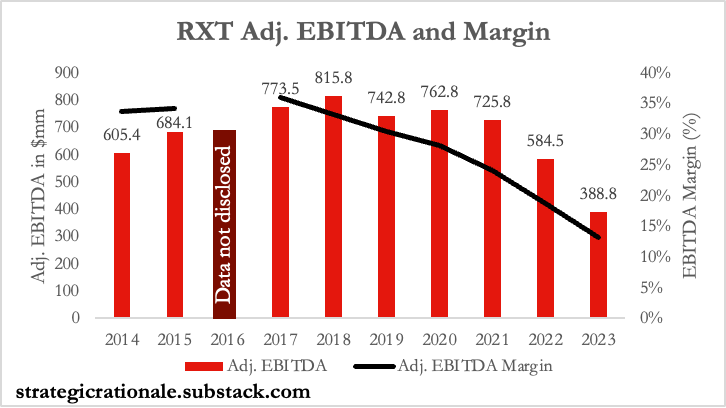

During the same period, Rackspace’s EBITDA declined from $605m at a 34% margin in 2014 to $389m at a 13% margin in 2023, further highlighting a lack of downside protection in its business model.

4. Rackspace has a “strong free cash flow profile”

This thesis point was realized as Apollo successfully increased Rackspace’s FCF (defined as EBITDA – capex) from $218m before the buyout to ~$500m most years after the buyout.

EBITDA declined significantly in 2023 primarily due to Rackspace paying down part of its long-term debt and recording a gain on debt extinguishment. Stable FCF was supported by a broad reduction in capex, achieved by shifting the business mix away from the capital-intensive Private Cloud segment towards the capital-light Public Cloud segment.

5. Rackspace has ample “operational improvement opportunities”

Operational cost savings were not achieved, as opex as a percentage of revenue increased from 70% before Apollo’s buyout to approximately 100% in the years following the purchase. However, this rise in opex is expected due to Rackspace’s transition to the lower-margin Public Cloud business.

Apollo executed several value-creation initiatives, including organizational restructuring, rebranding, and shifting Rackspace’s business mix.

As part of the organizational restructuring, Apollo replaced executive management and undertook layoffs (see thesis point 6 below).

Recognizing their inability to compete directly with the hyperscalers, Rackspace shifted its business mix. They began partnering with hyperscalers to provide managed services, deprioritizing their IaaS business (Openstack) and focusing more on Public Cloud rather than Private Cloud. This transition included launching a suite of value-added services such as database management, security services, application management, and data analytics.

To support this strategic shift, Rackspace engaged in M&A in an attempt to strengthen its position as the leading pure-play cloud MSP. Acquisitions included TriCore Solutions (enterprise applications MSP) for $335m, Datapipe (a competing cloud MSP) for $1bn, RelationEdge (Salesforce MSP) for $65m, Onica (AWS MSP) for $316m, and Just Analytics (provider of cloud-based data, analytics, and AI services) for $8m.

6. Rackspace has a “strong management team and culture that drives success”

The company culture at Rackspace has suffered significantly due to the replacement of many US-based employees with offshore workers. Since Apollo’s acquisition, Rackspace has undergone a series of layoffs, including a reduction of about 10% of the workforce in July 2021. Additionally, Rackspace has experienced considerable leadership instability, having seen four different CEOs since Apollo’s purchase.

The Future of Rackspace and Concluding Thoughts

The future trajectory of Rackspace remains uncertain. While there is potential for a turnaround as the company focuses on expanding its Public Cloud business and upselling higher value-add services, thereby improving margins, significant challenges persist. Rackspace’s $3.6bn debt burden and compressed margins pose genuine risks. With 2023 operating expenses surpassing revenue by over $800m, not factoring in ~200m in annual interest payments, the specter of bankruptcy looms large.

Despite taking the company public in 2020, Apollo has yet to fully exit its investment, still retaining 58% ownership of the company. Rackspace’s IPO debuted at a $21 share price. However, the company’s stock has plummeted, with a 50-day weighted average of $1.78 (as of May 31, 2024), reflecting a 90% decline in market cap since IPO. Presently, Rackspace has a market cap of ~$440m and an EV of ~$3.6bn.

Apollo purchased Rackspace for $4.3bn with a $1.3bn equity check; $860m of equity value (66% of Apollo’s equity investment) has been lost.

If you enjoyed reading this case study, consider subscribing below. We will continue to profile many more stand-out private equity investments like this one.

Appendix

History of Rackspace

Founding and early years (1998-2000)

Rackspace was founded in 1998 in San Antonio, Texas as a web hosting and application development company. The company shifted its focus solely to web hosting, recognizing the growing demand for hosting services in the burgeoning internet era – this led to the establishment of Rackspace.com as a dedicated web hosting service provider. The company quickly distinguished itself with its customer-centric approach, branding its service as “Fanatical Support,” which emphasized exceptional customer service as a core differentiator.

Early growth (2000-2008)

Rackspace grew rapidly during the dot-com boom, securing a significant customer base and expanding its infrastructure. After the burst of the dot-com bubble, the company diversified its offerings, introducing managed hosting solutions tailored to business clients. They catered to enterprises that required reliable, scalable, and secure hosting environments but lacked the in-house expertise to manage them. In 2008, Rackspace went public (NYSE: RAX), continued to scale through the development of data centers and add-on acquisitions, and launched its cloud computing division, Rackspace Cloud, marking its entry into the cloud market.

Rise to cloud leadership (2008-2011)

Rackspace became a founding member of OpenStack, an open-source cloud computing platform aimed to be a free alternative to proprietary cloud solutions like AWS. This move was strategic, positioning Rackspace as a leader in the open-source cloud space. Rackspace’s cloud services continued to gain traction and the company continued to expand its data center footprint globally. By 2011, Rackspace had become the #2 cloud provider globally, trailing only AWS [5].

Challenges and decline (2012-2016)

The cloud computing market became increasingly competitive with aggressive expansion by hyperscalers AWS, Azure, and Google Cloud Platform. Rackspace struggled to compete with the scale and pricing power of these giants. In 2014, Rackspace shifted its strategy to focus on managed cloud services, offering expertise and support for third-party cloud platforms, including AWS and Azure. Rackspace’s once competitors were now its business partners. The company offered multi-cloud and hybrid cloud solutions. Rackspace had fallen from a name once synonymous with cloud computing and was eventually taken private in 2016.

Rackspace Today

Today, Rackspace operates under a dual-business model comprising Public Cloud and Private Cloud segments.

The Public Cloud segment follows a service-centric, capital-light approach, offering cloud solutions for customer environments hosted on the hyperscalers. This segment primarily involves reselling infrastructure from hyperscalers bundled with managed cloud services. Additionally, Public Cloud included higher value-add services such as security, application management, and advanced data services. As a middleman between customers and the hyperscalers, this segment operates on low margins. Over time, margins are expected to improve as Rackspace cross-sells high value-add services.

The Private Cloud segment offers storage, computing power, and applications through three main services: cloud management (assisting customers in managing their cloud environments), managed hosting (using Rackspace-owned servers), and colocation (customers using their own hardware within Rackspace’s data centers). This segment is more mature and capital-intensive. Private Cloud customers are declining as businesses shift resources to the public cloud. This segment operates at higher gross margins but faces LSD negative growth.

Sources

1: Rackspace’s SEC filings.

2: https://www.sec.gov/Archives/edgar/data/1107694/000110465916149867/a16-19796_1ex99d1.htm

3: https://www.zippia.com/advice/cloud-adoption-statistics/

4: https://cloud.folio3.com/blog/top-managed-cloud-service-providers/#Comparison-Table

5: https://www.infoworld.com/article/2624156/no--2-cloud-provider-rackspace-tries-harder.html