Inside the Thoma Bravo Playbook: A Quantitative Analysis [Part 1]

Exploration of Thoma Bravo's public-to-private-to-public investments

Introduction

This two-post series delves into the intricacies of the Thoma Bravo “playbook” by examining the transformative financial and operational changes orchestrated by Thoma Bravo across three publicly traded companies– Instructure, SolarWinds, and Informatica. In each instance, Thoma Bravo acquired a publicly traded company and, following 2-6 years of private management, subsequently retook the company public. Such transactions provide us with the unique opportunity to scrutinize a company’s financial statements both before and after Thoma Bravo’s engagement.

Our focal point in this initial post is the analysis of Instructure’s financial statements with a subsequent post unraveling the financial narratives of SolarWinds and Informatica, along with themes across the three deals.

Background

Instructure

Instructure is a major player in the education technology field, driving student success and amplifying the power of teaching. Their flagship product, Canvas, is a leading learning management system (LMS) used by over 30 million educators and learners across more than 7,000 organizations globally.

Canvas is a cloud-based LMS, accessible through a web browser and mobile app. It is the LMS market leader in both Higher Education and paid K-12. Canvas’s robust features encompass course management (content creation, assignments, grading), communication and collaboration tools (discussion boards, messaging), and assignment tools (quizzes, exams, rubrics), integrating with key third-party ed-tech tools like Google Drive, Microsoft Office, and Zoom. Instructure competes with other LMSs, namely Blackboard, Moodle, Brightspace, and Google Classroom.

Instructure operates with a subscription-based SaaS model. Institutions subscribe annually or multi-yearly (typical contract lengths are between one and five years), with contract cost driven by the number of users affiliated with the institution. Additionally, customers have the option to purchase premium support beyond to the standard support. Collectively, subscriptions and support make up to approximately 90% of Instructure's revenue.

Instructure went public on November 13th, 2015, with its shares priced at $16.

Thoma Bravo

Thoma Bravo is a US-based private equity firm specializing in investments within the software and technology sectors. On December 4th, 2019, Thoma Bravo announced its acquisition of Instructure in an all-cash transaction valued at approximately $2 billion. Shareholders received $49 per share, and the transaction was financed with $1.2 billion of debt, according to PitchBook.

On July 22nd, 2021, Instructure returned to the public market. Considering 2019 marks the last year for which Instructure reported a 10-K before the buyout, and 2021 represents the first full year following Thoma’s involvement, our primary focus will be comparing these two pivotal years to evaluate the changes Thoma Bravo made to Instructure. In each of the following charts, these two comparative years are bolded.

See the appendix for Instructure’s full financial statements.

Margin Analysis

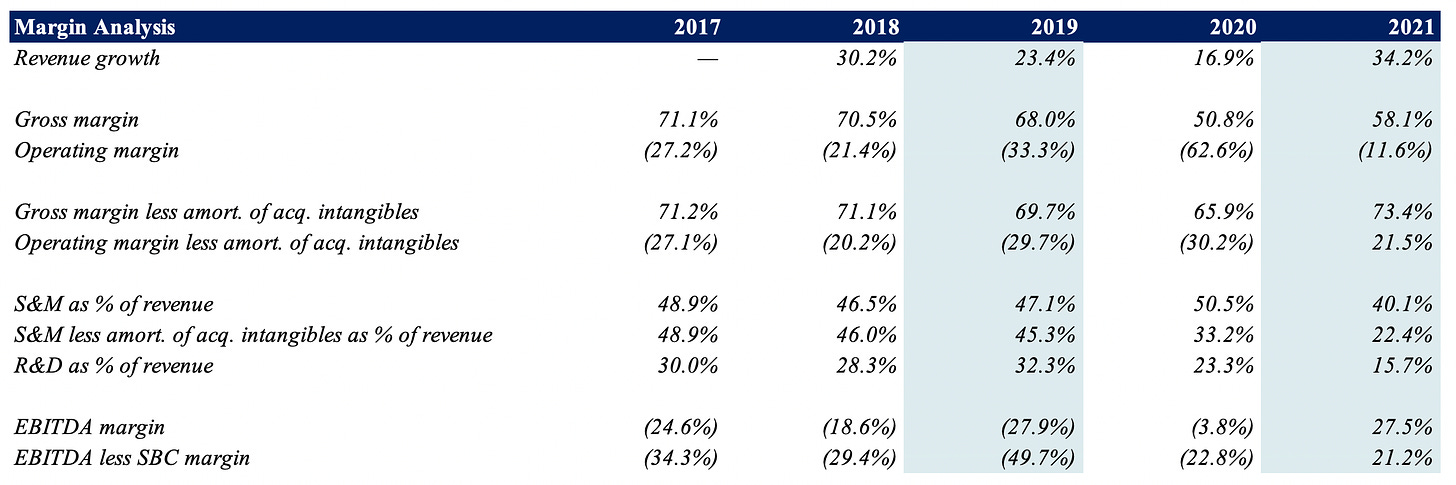

Revenue growth and customer expansion

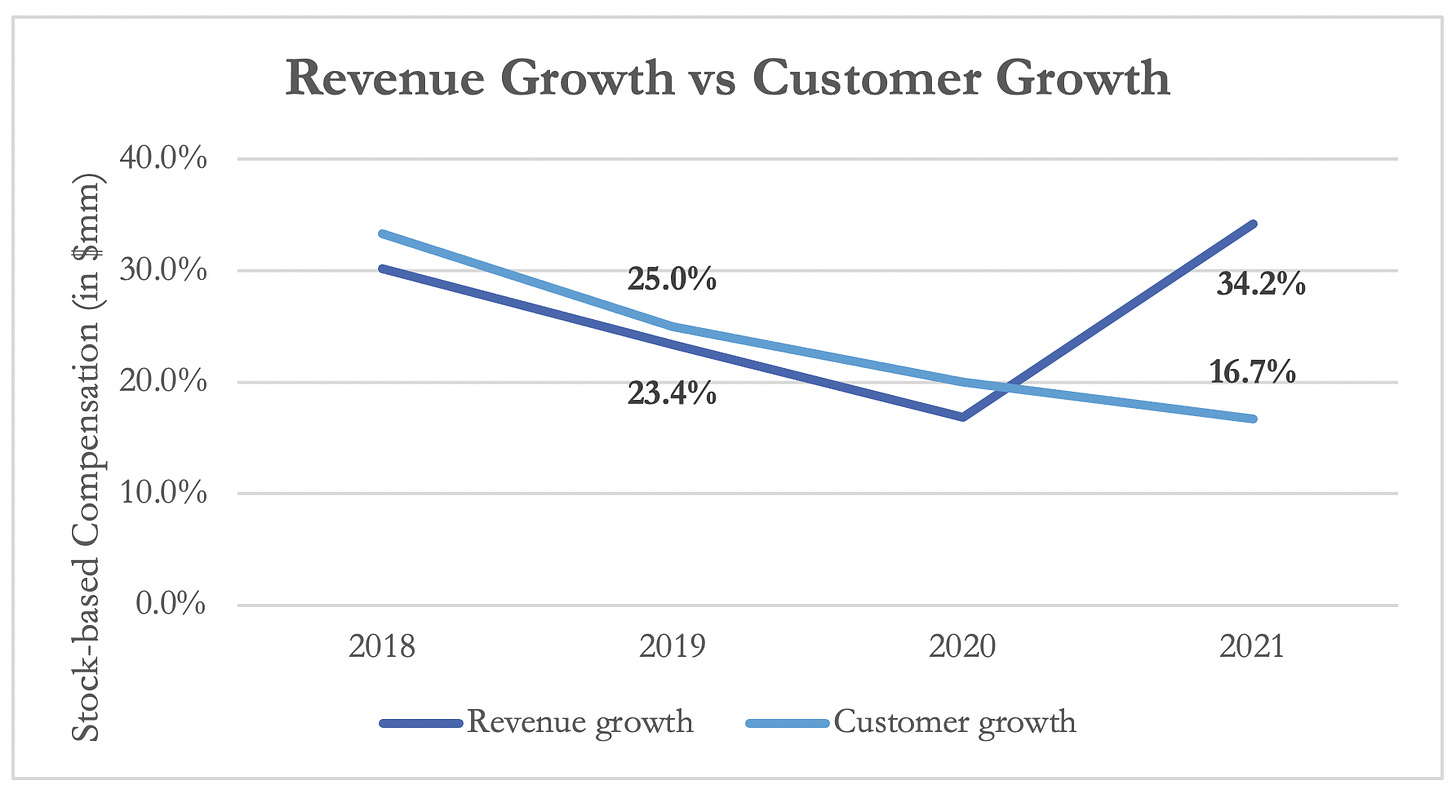

In the span between 2019 and 2021, Instructure's revenue surged from $258 million to $405 million with revenue growth increasing from 23% to 34%. Meanwhile, Instructure’s customer base expanded from approximately 3,000 to nearly 7,000 during the same period.

Plotting revenue growth against customer expansion unveils a notable departure from historical trends. While prior to Thoma Bravo's involvement, revenue growth paralleled customer growth, 2021 witnessed a distinctive shift. Revenue surged by 34% while growth in customer base staggered to 17%. This signals a departure from the conventional strategy of revenue increase through customer acquisition, indicating a strategic pivot towards increasing revenue through increases in prices for new or existing customers.

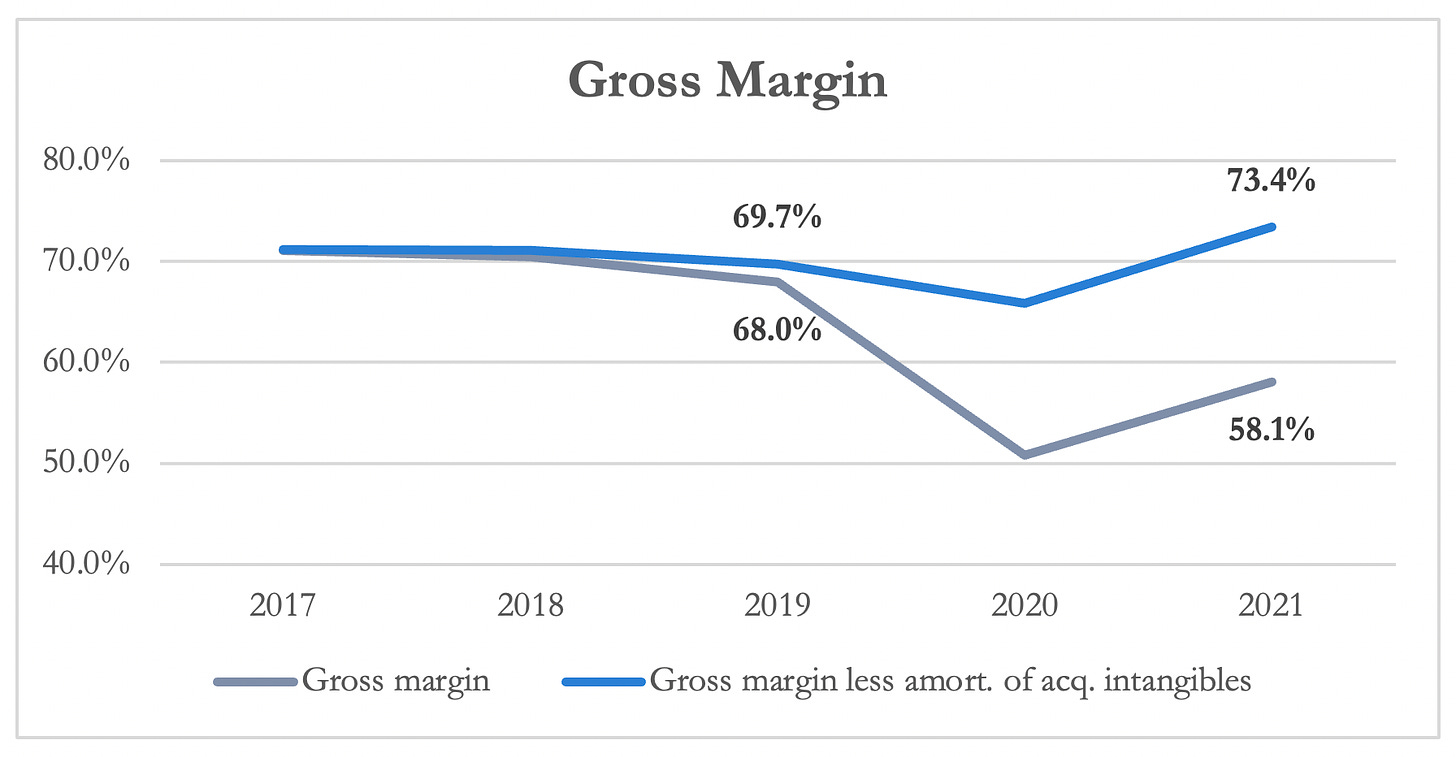

Gross margin

Post Thoma Bravo’s involvement, gross margins seemingly declined from 68% to 58%. A closer examination, however, reveals that the apparent decline is attributed to a $62 million increase in “amortization of acquisition-related intangibles” (due to Thoma’s buyout) within the Subscription and Support line item in Cost of Revenue. Adjusting for this accounting formality, which has no impact to Instructure’s cash flow or EBITDA, unveils an adjusted gross margin of 68% in 2019 and a slight, non-notable improvement to 73% in 2021.

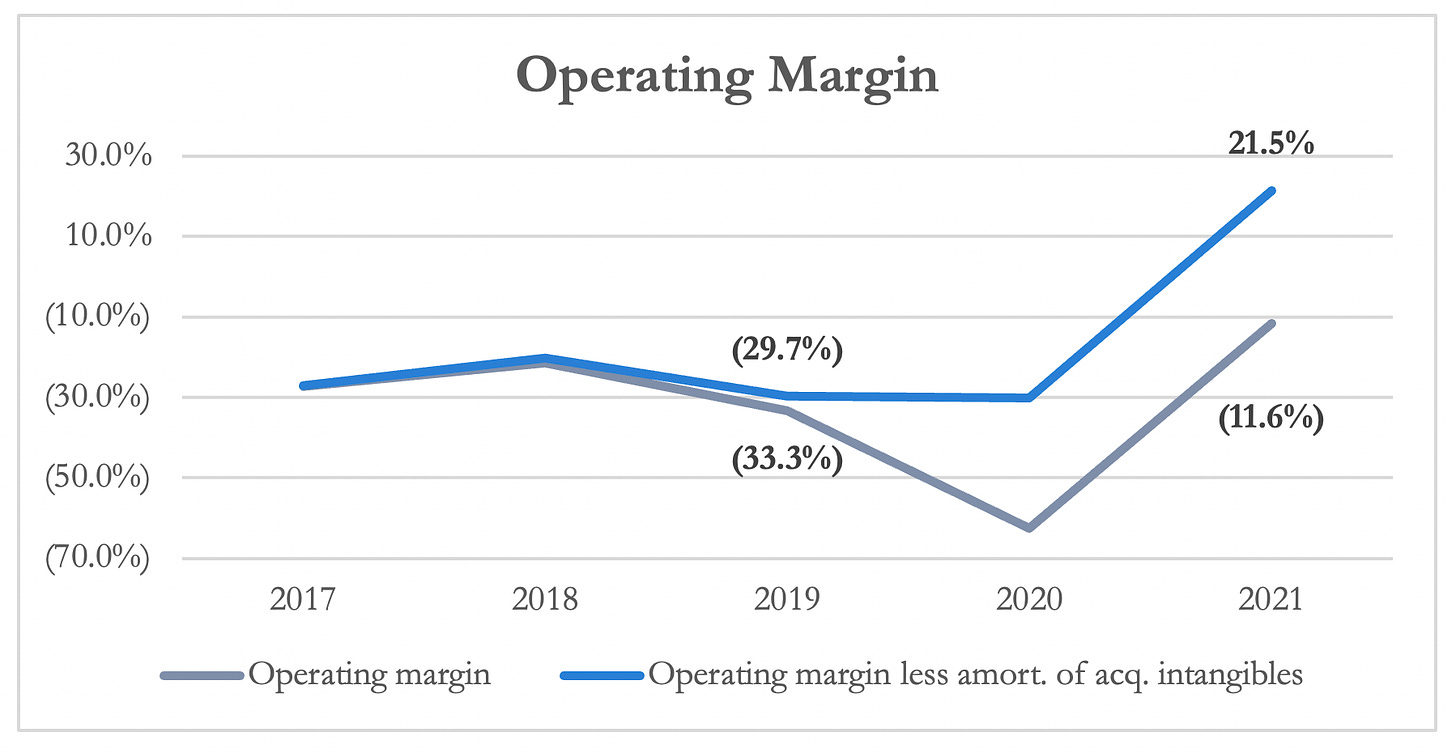

Operating margin

Like gross margin, operating margin, seemingly improving from -33% in 2019 to -12% in 2021, also undergoes a substantial transformation upon closer inspection. The significant understatement is attributed to the inclusion of acquisition-related intangibles in the Sales and Marketing line item. Adjusting for this reveals an impressive improvement from -30% in 2019 to 21% in 2021, representing a remarkable 51% enhancement. This shift is predominantly fueled by a substantial reduction in both sales and marketing and research and development expenditures.

Sales and marketing, research and development spend

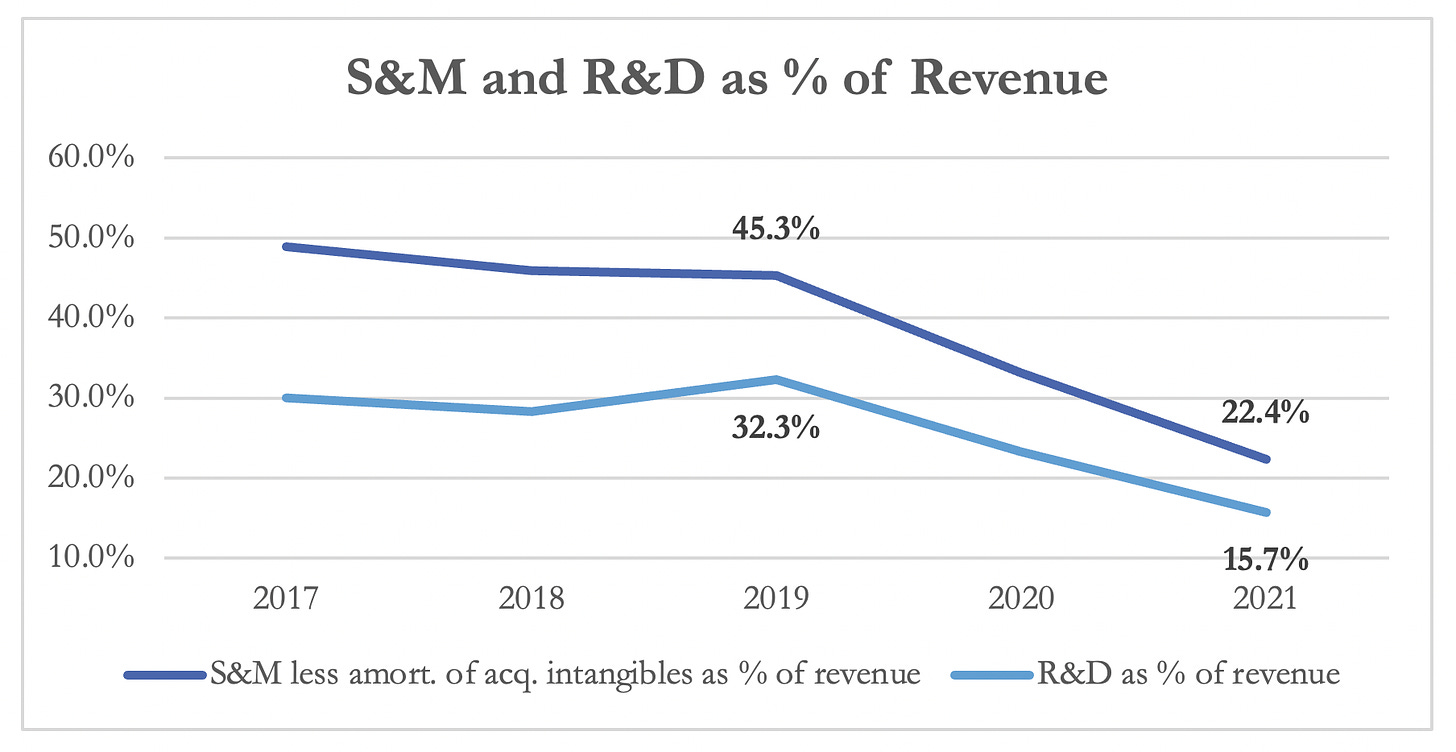

At surface level, sales and marketing expense (S&M) as a percentage of revenue appears to merely decrease from 47% to 40% from 2019 to 2021. However, upon subtracting acquisition-related amortization, the true magnitude of the reduction becomes apparent – a decline from 45% to 22%, equating to a decrease from $117 million to $91 million. Similarly, research and development (R&D) as a percentage of revenue witnessed a decline from 32% to 16%.

EBITDA margin

Capital IQ reports a noteworthy transformation in Instructure's EBITDA, shifting from -$72 million in 2019 to $112 million in 2021, equating to a 55% margin increase from -28% to 28%. Further adjustments for stock-based compensation propel EBITDA margins from -50% to 21%, underscoring the multifaceted improvements in operational efficiency.

Headcount and Stock-based Compensation Analysis

Headcount

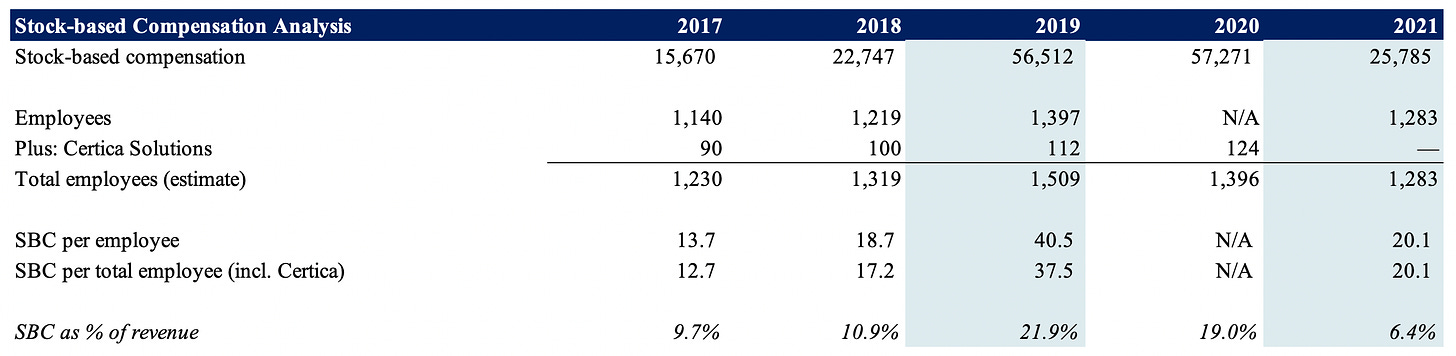

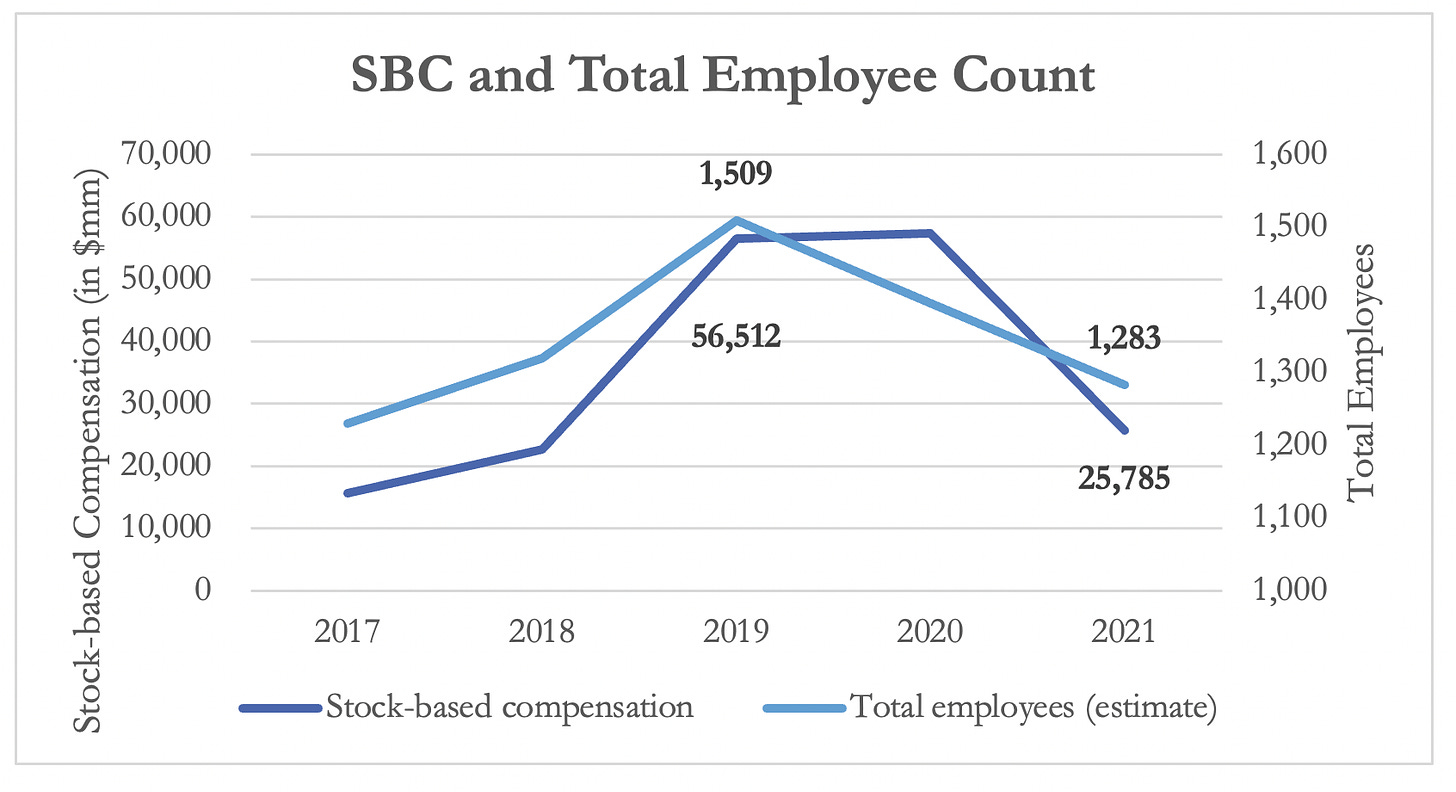

As of December 31st, 2019, Instructure reported a headcount of 1,397 employees. On December 10th, 2020, Instructure acquired Certica Solutions, which added 124 employees to Instructure, according to PitchBook. To calculate total headcount–the sum of the employees at Instructure and Certica–we adjust for a 10% discount in Certica’s employee count for each year prior to 2020. Consequently, Instructure's estimated headcount for FY 2019 stands at 1,509 employees.

In 2021, Instructure disclosed a total headcount of 1,283 employees, reflecting an 8% reduction compared to 2019. The headcount for 2020 is approximated as the average of the employee count in 2019 and 2021.

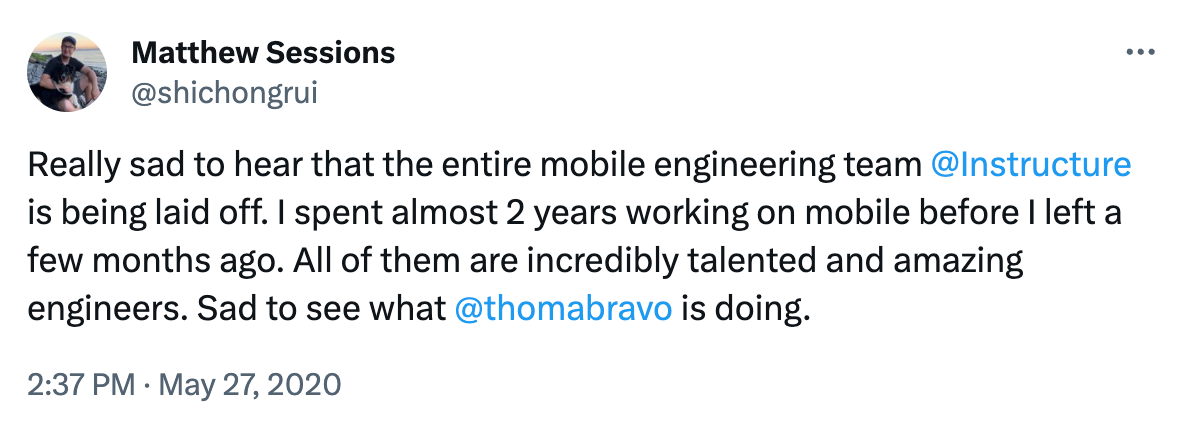

It's noteworthy to mention that while not formally documented in Instructure's financial statements, the company underwent significant workforce adjustments in January 2020. Around 100 employees were laid off as Instructure approached a crucial shareholder vote on the proposed sale to Thoma Bravo. Most of these layoffs were concentrated in the money-losing Bridge platform, designed for corporate learning. Bridge was an endeavor to emulate Instructure’s success in the K-12 and Higher Education markets. Post Thoma Bravo's acquisition, another 150 employees were let go in May 2020, representing more than 10% of Instructure's workforce. According to a previous Instructure engineer, the entire mobile engineer team was among those laid off. Cumulatively, these two rounds of layoffs represent a substantial reduction, accounting for nearly 20% of the full-time staff removed since the beginning of the year.

Stock-based compensation

Over the same period, Instructure witnessed a substantial 54% reduction in total stock-based compensation, decreasing from $57 million to $26 million. On a per-employee basis, stock-based compensation saw a 50% decline, dropping from $40 million to $20 million. Furthermore, stock-based compensation as a percentage of revenue experienced a significant decrease, plummeting from 22% to a mere 6%.

This trend underscores Instructure's challenge in controlling its stock-based compensation expense as a public company, which resulted in considerable dilution for equity holders on an annual basis. Thoma Bravo, upon its involvement, successfully adjusted the stock-based compensation framework, proving advantageous for itself as a significant equity holder. In essence, a larger share of the potential future value creation, such as EBITDA expansion and multiple expansion, is now directed towards the current equity holders, which is now Thoma Bravo.

Consequently, the intrinsic value of Instructure during Thoma Bravo's acquisition, as evaluated by Thoma, surpassed that perceived by public market investors. This discrepancy arises from Thoma Bravo's ability to actively influence and rectify Instructure's stock-based compensation burden, a capability not readily available to public market investors.

Property and Equipment

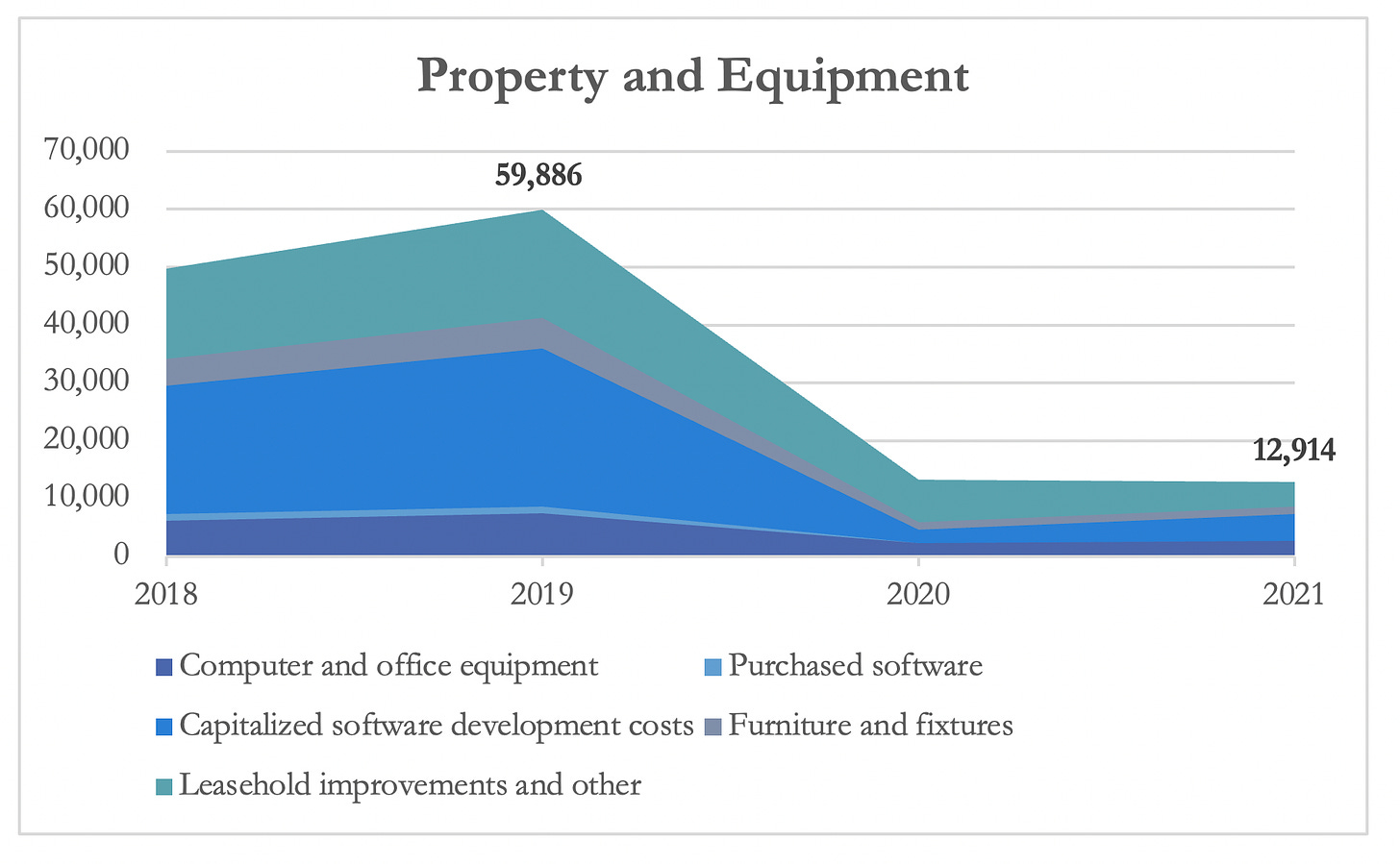

Under Thoma Bravo's management, Instructure witnessed a substantial reduction in its Property and Equipment (PPE) expenditure, with a noteworthy impact on the corresponding balance sheet figures. A particular focus is placed on the Purchased Software and Capitalized Software Development Costs sub-line items, which serve as key indicators of Instructure's growth capital expenditure, intended to fuel future organic growth. Capitalized Software Development Costs encompass expenses incurred during the application development stage that significantly enhance and introduce new functionality to the cloud-based learning, assessment, development, and engagement system [4].

Between 2019 and 2021, Purchased Software saw a reduction from $1 million to $0, while Capitalized Software Development Costs plummeted by 83%, declining from $27 million to $5 million. The proportion of Capitalized Software Development Costs to revenue diminished from 11% in 2018 and 2019 to a mere 1% in 2020 and 2021.

The remaining sub-line items under PPE, including Computer and Office Equipment, Furniture and Fixtures, and Leasehold Improvements, also experienced significant decreases, each dropping between 60% and 80% from 2019 to 2021.

In addition to these reductions, a strategic decision was made to close nearly all of Instructure's U.S. offices outside of the Salt Lake City headquarters. Offices in Chicago, Seattle, San Diego, and London (overseeing EMEA operations) were among those closed [12]. This restructuring signifies a comprehensive realignment of Instructure's physical assets in line with its evolving operational strategy under Thoma Bravo's influence.

Financing Activities

Instructure experienced a significant cash inflow of $259 million from its 2021 IPO. The majority of these proceeds, amounting to $224 million, were utilized to make a principal prepayment on the company's outstanding Term Loan [6]. Subsequently, in October 2021, Instructure undertook a debt restructuring initiative, refinancing all existing debt totaling $830 million with a new $500 million term loan. This strategic move represents a deliberate effort to optimize the company's debt structure and financial position.

Concluding Thoughts

Generally, companies can choose to allocate excess capital in one of four primary ways: capital expenditures for growth; adverting and promotion or research and development; mergers and acquisitions; and distributions to shareholders.

With a notable decrease in growth capital expenditures, Sales and Marketing (S&M) expenses, and Research and Development (R&D) investments, Thoma Bravo reallocated Instructure's surplus capital away from future growth initiatives towards shareholder distributions, primarily in the form of debt repayment. In broad strokes, Thoma Bravo implemented the following transformative changes:

Implemented price increases, to boost revenue growth 11%.

Reduced S&M and R&D as a percentage of revenue by 23% and 17%, resulting in a substantial 51% expansion in operating margin.

The above changed increased EBITDA margins by roughly 55%.

Implemented a reduction in employee count.

Reduced SBC as a percentage of revenue from 22% to 6%, accruing more value creation to Thoma Bravo.

Decrease Capitalized Software Development Costs (PPE) from 11% to 1% of revenue, rebalancing future growth and operating efficiency.

Collectively, these changes significantly enhanced the overall value of Instructure, transforming it into a more profitable, efficient business.

As we navigate the intricate financial landscape of Instructure, the Thoma Bravo playbook unfolds with strategic nuances that redefine the company's trajectory. Join us in part 2 of The Thoma Bravo Playbook: A Quantitative Analysis as we delve into the financial narratives of SolarWinds and Informatica, two other Thoma Bravo public-to-private-to-public transactions, and outline the overarching themes across these three transactions.

Appendix

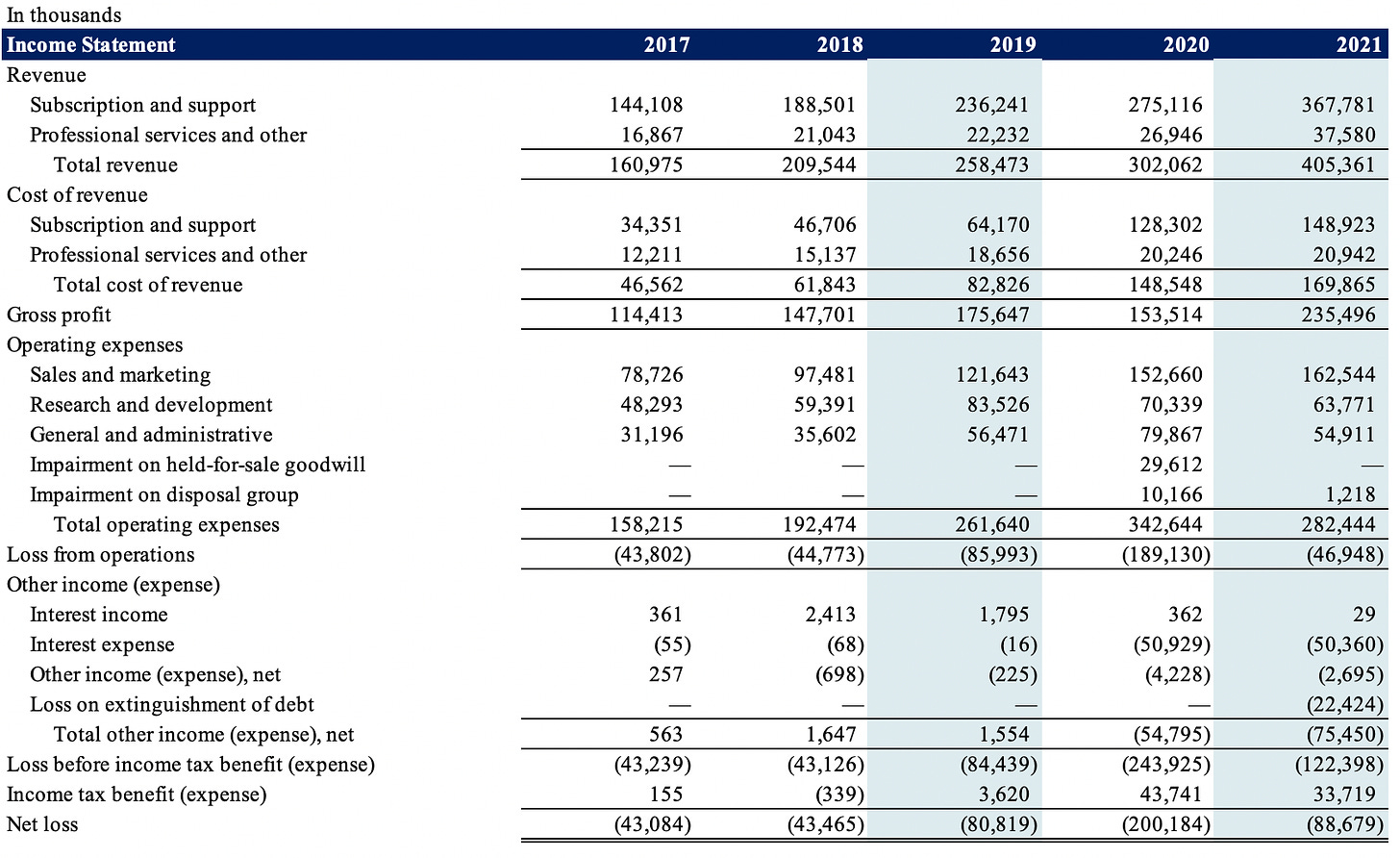

Income Statement

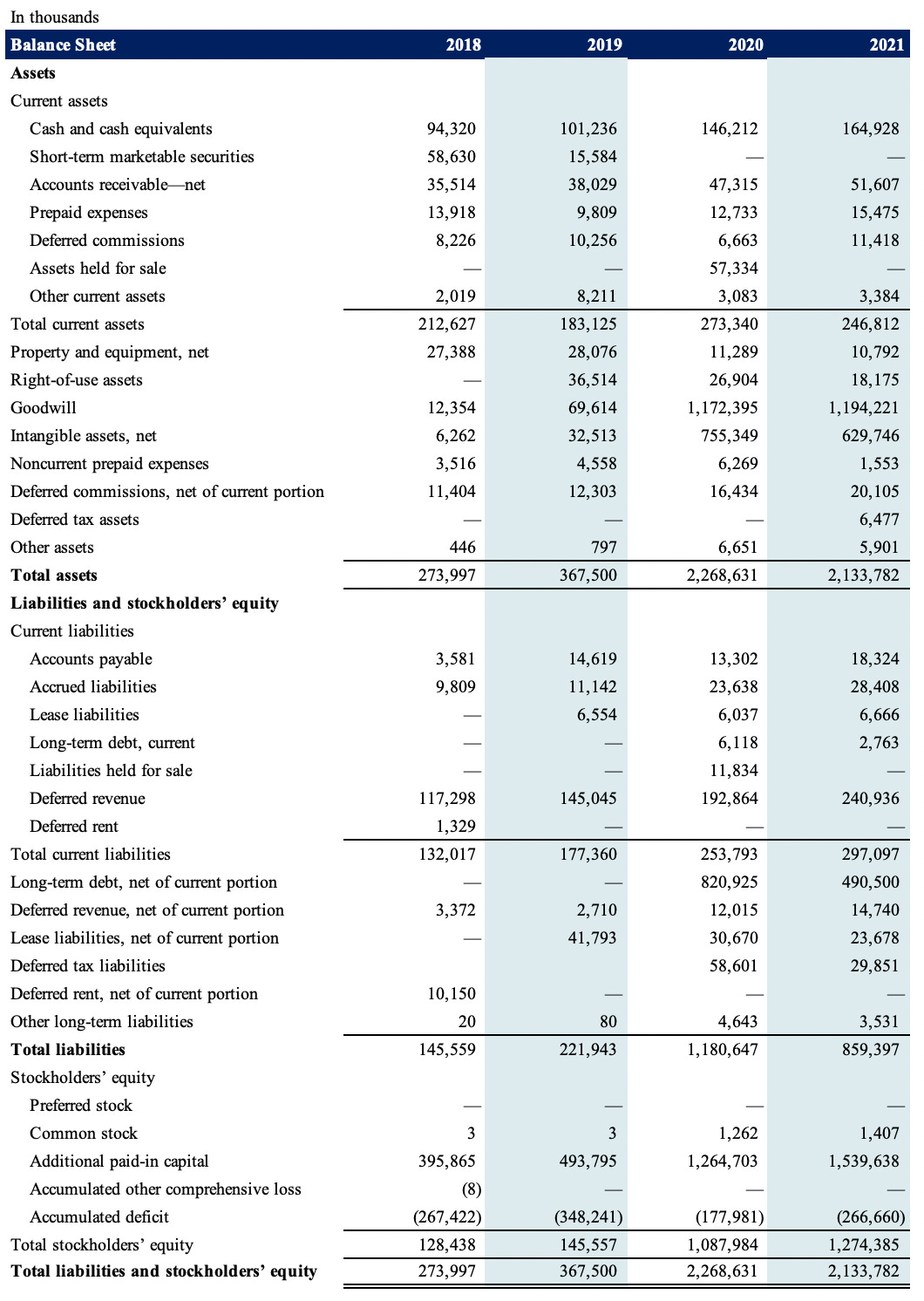

Balance Sheet

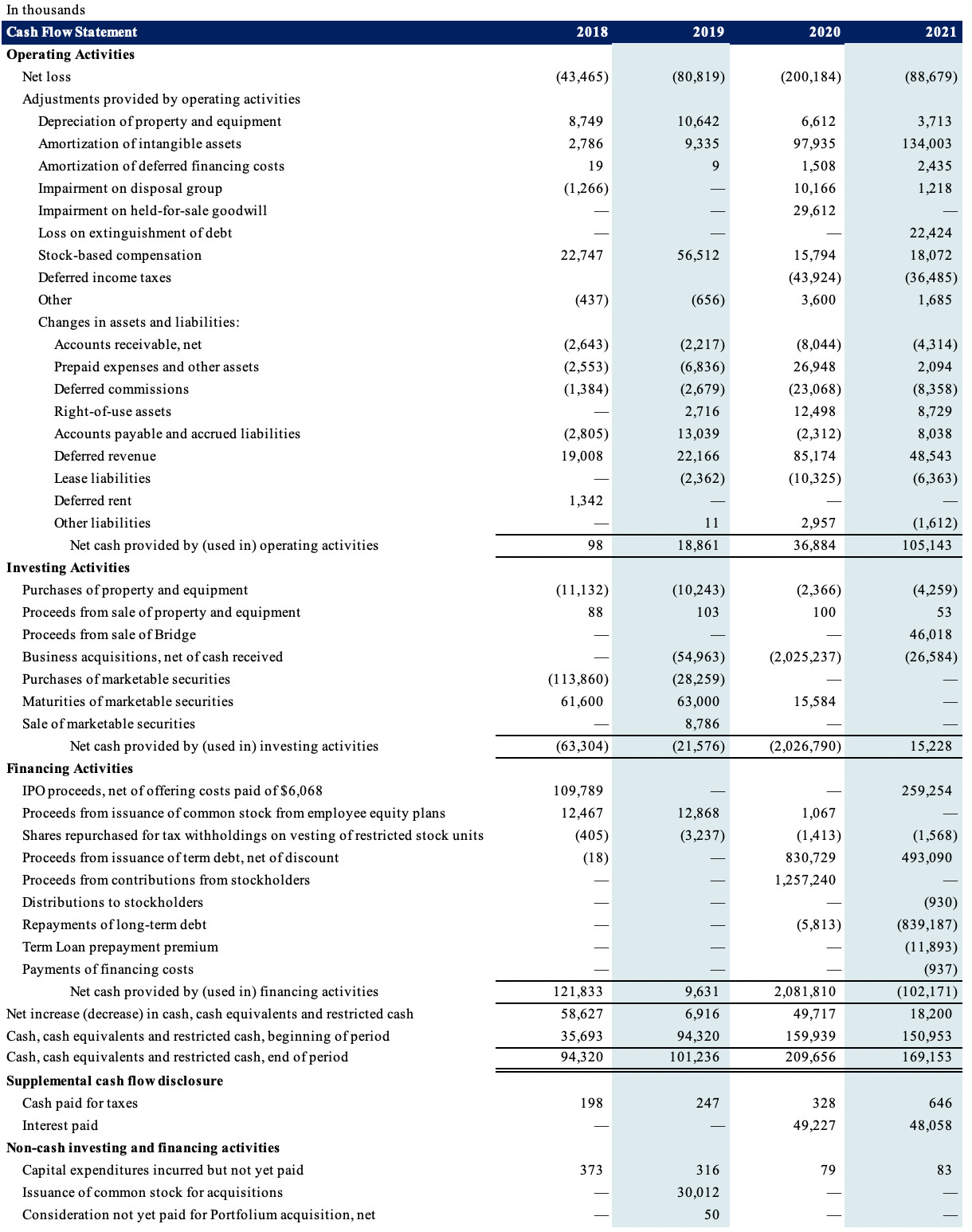

Cash Flow Statement

tl;dr

You didn't need to make this article so complicated.

The fact of the matter is the TB playbook is purchase -> gut the company to pump up the valuation -> divest in 3 years.